[vc_row full_width=”stretch_row_content_no_spaces”][vc_column][vc_empty_space height=”100px” el_class=”mobile_space”][vc_row_inner equal_height=”yes” content_placement=”top” el_class=”container mobile_reverse”][vc_column_inner][vc_column_text]More often than not companies undervalue the true cost of carrying too much inventory. There are significant and real costs associated with carrying inventory that are an order of magnitude more than a company’s cost of capital (the metric that most financial executives use). We will explore the true financial impact of reducing inventory at a fictitious hardware manufacturer – ABC Technologies.

ABC Technologies is a chip manufacturer with $100 million in revenue and gross margins of 43%. For illustrative purposes we are going to assume that all revenue and costs other than those associated with inventory remain flat year-over-year. Let us walk through the impact that a fairly conservative inventory reduction of 20% has on the business by reviewing changes in the financial statements.

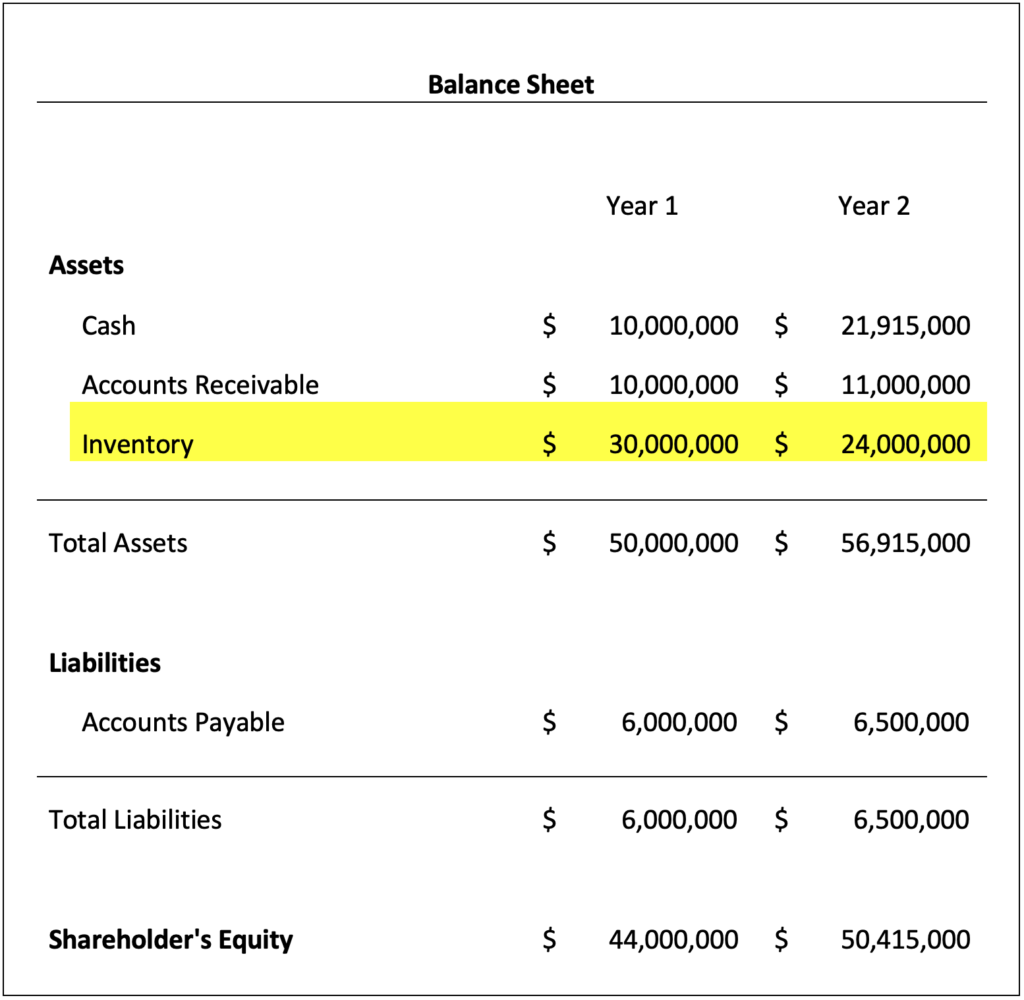

On the balance sheet we see a reduction inventory from $30m to $24m which in turn has a positive impact on shareholder equity through retained earnings.

[/vc_column_text][vc_column_text]This decrease in inventory assets is also reflected on the cashflow statement through a one time increase in operating cashflow of $6m.

[/vc_column_text][vc_column_text]This decrease in inventory assets is also reflected on the cashflow statement through a one time increase in operating cashflow of $6m.

[/vc_column_text][vc_column_text]Along with the above impacts industry experts estimate that the true carrying costs of inventory range from 25% – 55%. Taking the conservative end of this range we find $1.5m in savings that flow through to ABC Technologies every year. We are accounting for this as a separate line item to highlight it but in reality, these savings are typically found throughout COGS and General and Administrative.

[/vc_column_text][vc_column_text]Along with the above impacts industry experts estimate that the true carrying costs of inventory range from 25% – 55%. Taking the conservative end of this range we find $1.5m in savings that flow through to ABC Technologies every year. We are accounting for this as a separate line item to highlight it but in reality, these savings are typically found throughout COGS and General and Administrative.

[/vc_column_text][vc_column_text]By reducing inventory 20% ABC Technologies has been able to drive significant one time and recurring financial improvements across their organization.

[/vc_column_text][vc_column_text]By reducing inventory 20% ABC Technologies has been able to drive significant one time and recurring financial improvements across their organization.

[/vc_column_text][vc_column_text]The other component that CFO’s and supply chain executives have to balance against inventory levels is service levels. While inventory and service levels are inversely correlated at a high-level, inventory optimization gives companies the power to reduce inventory levels while simultaneously increasing service levels. Understanding how to set service levels at a part level so that they align with overall company service level goals will allow ABC Technologies to both increase service levels and decrease inventory.[/vc_column_text][/vc_column_inner][/vc_row_inner][/vc_column][/vc_row][vc_row full_width=”stretch_row_content_no_spaces”][vc_column][vc_empty_space height=”100px” el_class=”mobile_space”][vc_separator color=”custom” accent_color=”rgba(196,196,196,0.6)”][vc_empty_space height=”125px” el_class=”mobile_space”][/vc_column][/vc_row][vc_row][vc_column][vc_row_inner el_class=”container”][vc_column_inner][vc_related_posts post_type_taxonomy=”whitepapers-category”][vc_empty_space height=”130px” el_class=”mobile_space”][/vc_column_inner][/vc_row_inner][/vc_column][/vc_row]

[/vc_column_text][vc_column_text]The other component that CFO’s and supply chain executives have to balance against inventory levels is service levels. While inventory and service levels are inversely correlated at a high-level, inventory optimization gives companies the power to reduce inventory levels while simultaneously increasing service levels. Understanding how to set service levels at a part level so that they align with overall company service level goals will allow ABC Technologies to both increase service levels and decrease inventory.[/vc_column_text][/vc_column_inner][/vc_row_inner][/vc_column][/vc_row][vc_row full_width=”stretch_row_content_no_spaces”][vc_column][vc_empty_space height=”100px” el_class=”mobile_space”][vc_separator color=”custom” accent_color=”rgba(196,196,196,0.6)”][vc_empty_space height=”125px” el_class=”mobile_space”][/vc_column][/vc_row][vc_row][vc_column][vc_row_inner el_class=”container”][vc_column_inner][vc_related_posts post_type_taxonomy=”whitepapers-category”][vc_empty_space height=”130px” el_class=”mobile_space”][/vc_column_inner][/vc_row_inner][/vc_column][/vc_row]